Department of Education, Skills and Employment announces transition to new skills and workforce development model.

Skills Ministers agreed to establish new industry-based clusters (Industry Clusters) with broad roles and responsibilities for skills and workforce development by December 2022. Industry Clusters will replace Industry Reference Committees (IRCs), Skills Service Organisations (SSOs) and Skills Organisation Pilots (SOs).

Key Extracts from the Transitional Advisory Group (TAG) Advice to Government 31st August.

The Industry Clusters will be established “by industry – for industry”, effectively engendering a level of industry ownership at the senior leadership level from the outset.

Under the new model, industry engagement will occur at both a Strategic level (in terms of engagement of industry leaders to assemble workforce intelligence and to prioritise the development of qualifications and training products) and at an Operational Level (where industry practitioners will develop qualification and training products and work cooperatively with (RTOs) to identify and implement improvements to ensure delivery also meets employer needs.

A core performance requirement of these organisations will be quality engagement of a representative cohort of diverse stakeholders to ensure that key stakeholders in small businesses and niche industries are given a proportionate voice across the system, thereby improving employer engagement and access to the system over time.

A reduced number of Industry Clusters, from 67 Industry Reference Committees (IRCs) down to around nine to 15 Industry Clusters, with formal mechanisms to support cross-collaboration at the strategic and practitioner levels.

Industry Cluster functions

Skills Ministers agreed that Industry Clusters will have four broad functions and responsibilities:

- Workforce planning, seeking to address workforce challenges through strategies to identify, forecast and respond to skills needs across a range of educational pathways, including VET and higher education.

· Occupational standards and training product development, including improving the quality, speed to market and responsiveness of training products. This includes piloting emerging products and testing new approaches to meet workforce, skills, and industry needs.

· Implementation, promotion and monitoring function, working to build an end-to-end approach to training product development and deployment, and working with the National Careers Institute to develop and promote career pathways into, within and across industries.

· Industry stewardship, acting as a source of intelligence on issues affecting their industries.

Industry engagement Architecture

The Transition Advisory Group advice recognises that Skills Ministers have already made a number of decisions in regard to the industry engagement architecture, including to:

- provide Skills Ministers with responsibility for policy setting, owning the Training Package

Organising Framework, monitoring performance of the system, and retaining authority for

endorsing major updates to training packages; and

· establish an independent approval body to replace the Australian Industry and Skills

Committee (AISC) with a narrower role to assess training product compliance against the

Training Package Organising Framework.

Governance of Industry Clusters

The Transition Advisory Group considered that, on balance, Industry Clusters would be best served by being established as not-for-profit companies, limited by guarantee. This would ensure that boards were focused on delivering on the purpose and public good that the entity was established to produce and not focused on generating a profit.

The Transition Advisory Group considered membership structures to ensure industry ownership of the clusters, cautioning against any approach being too prescriptive. The membership model may need to be tailored to address the unique features of the industries represented by the cluster, that balances the interests of all relevant industry stakeholders.

Boards

The Transition Advisory Group acknowledged the need to ensure Industry Clusters were established

with high performing boards that were well regarded with the majority of board members drawn from their industries. It was not considered necessary that board members were drawn from all sectors within their cluster, and it was recognised that for some clusters a representational board would mean too many members to be manageable or effective in delivering on the strategic direction required for the cluster.

The Transition Advisory Group recognised the groupings based on ANZSIC codes was a stronger organising framework, offering more cohesion in the groupings, than the previous version used in consultation with the sector, but noted that flexibility was needed for industries to self-select into which cluster they best aligned with. It acknowledged that there should be a coherent relationship between the Industry Clusters and the industries it represents.

Cluster operating model

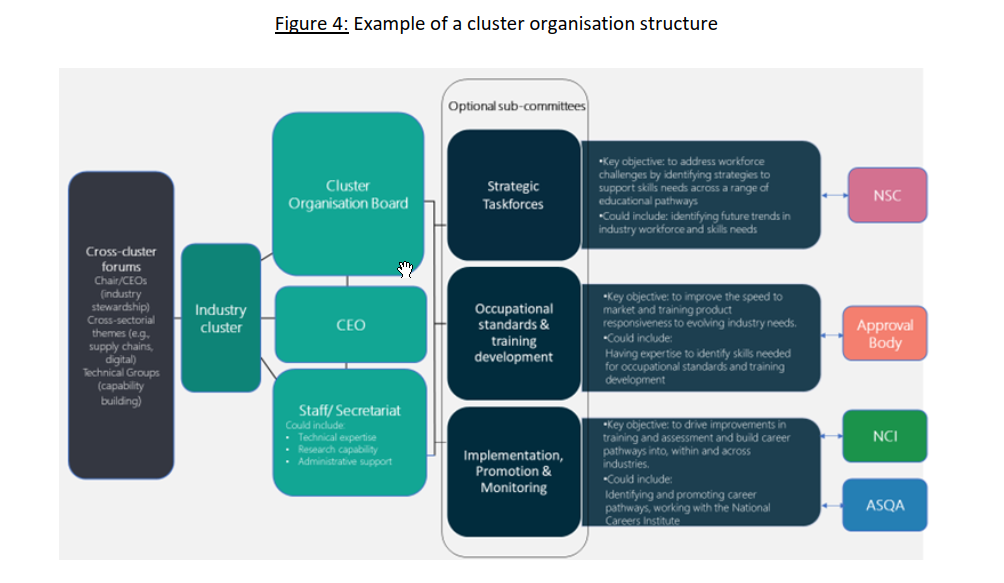

Clusters needed autonomy to determine the organisational and taskforce/sub-committee structures however, it was considered that some guidance should be provided (figure 4) could provide guidance for Industry Clusters.

Strategic Taskforces and Technical Advisory sub-committees

Strategic taskforces will be pivotal to bring a strong, strategic industry voice to the cluster, drawing on intelligence and insight across industry. It is important that the strategic taskforces could attract senior leadership from employers within their sectors, to ensure the individuals around the table are well versed in the workforce challenges and can provide considered, robust and strategic input.

CEO and secretariat

A secretariat/operational function within the cluster organisation that comprises the staff needed to deliver on the key functions of the Industry Cluster and provide technical expertise and administrative support to the sub-committees.

Cross-cluster forums

The system will support the establishment of cross-cluster forums and mechanisms to share intelligence, discuss economy-wide issues, deliver on cross-sector projects and develop communities of practice to build capability of clusters.

Establishment Approach to market

An open approach to market delivered in two stages to support clusters with greater autonomy to self-organise and establish a specific purpose industry-based organisation with appropriate sub-structures.

The first stage of the process, initial Expression of Interest (EOI) for industry groups/individuals to bring forward proposals to establish an Industry Cluster. Applicants need to demonstrate that they had the support of industries within their remit, the necessary technical and research experience and the capacity to establish strategic dialogue with a representative cohort of industry stakeholders. The second stage of the process would require the successful applicants from the EOI, once their organisation was established or re-constituted, to submit a formal proposal demonstrating their capability to deliver on the core functions set out in the program guidelines, including how they would meet performance requirements.

Transition – training product development arrangements

The preferred position is to keep in place all existing architecture (i.e., IRCs and SSOs) until the end of 2022, with all training packages to be transitioned to new Industry Clusters towards the end of next year.