The recent presentation on Container movements through Melbourne Port paints a very interesting picture on Australia’s international trade. The Australian Furniture Association was interested to learn how the changing tariff environment might affect your business? Delivered by Saul Cannon – CEO of Melbourne Port, as part of a Victorian Chamber of Commerce and Industry webinar, a summary of port container volumes and their breakdown by country and industry helps put furniture businesses into context in our greater economic environment and considers how tariffs might affect the big picture.

Here are some of the key takeaways:

Port of Melbourne is Australia’s largest general cargo and container port processing 3.4 million containers per year, based on 2,634 ship visits and processing over $150 billion in trade value annually.

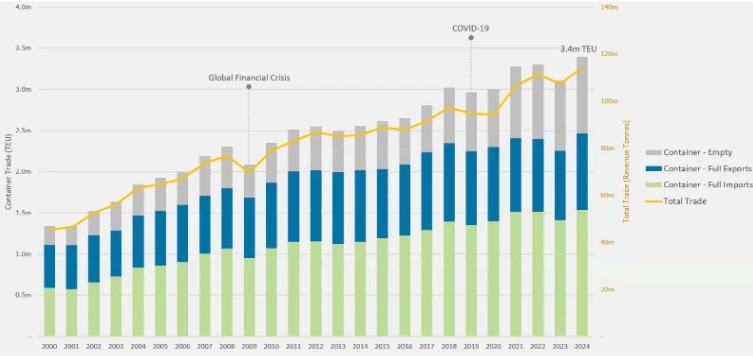

A snapshot of historical container trade and revenue through Melbourne Port is shown below. Trade is growing at a compounding rate of around 3% pa. Whenever there is a shock to the system there is an instant rebound. The message is to expect a similar trend if industry suffers a tariff shock this time around.

Volume through the port is expected to double over the next 30 years. This is dependent though on a consistent population growth locally and consistent economic growth in China – our major trading partner.

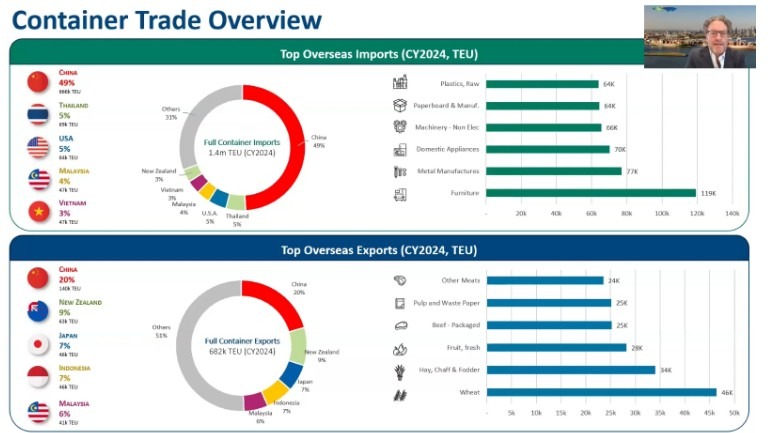

The 2024 trade picture broken into the countries shows the origin of containers and the export destinations in the following graphic. This includes the major breakdown of goods into categories in each case. China is the country of Origin of nearly half the inbound containers, and furniture forms the largest of the groups of import categories.

119,000 Containers of furniture were imported to Melbourne port in 2024 alone!

Regarding exports, China’s share was over 30% in the period before the one shown, but it dropped to 20% mainly due to the punitive tariffs China imposed. The key point is that other countries increased their import volumes by the same amount during this period, allowing Australia to swiftly “pivot” its exports to these other nations in response to the tariffs from its major trading partner.

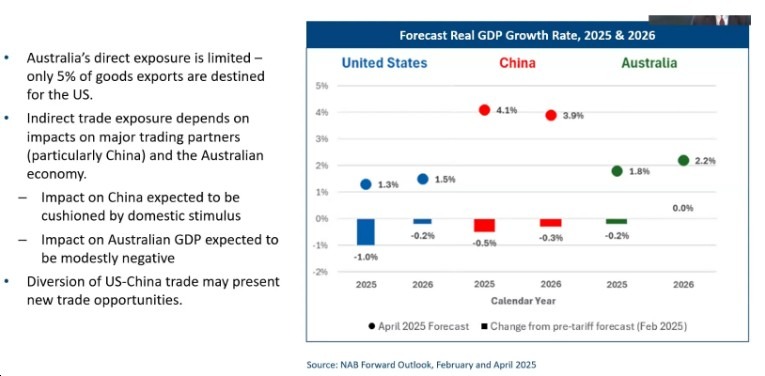

The NAB outlook outlining their assessment of the effects of US tariffs on expected GDP Growth forecasts is depicted below. A negative impact is greater in the US and China.

The main take out from the presentation is that Australia is skilled at navigating global economic shocks and has a strong track record of adapting to changing tariffs. Another key message is that due to the high level of uncertainty, it is very difficult to predict future developments. Since the presentation, the US Government has reversed many of the tariff conditions it had imposed. Regarding furniture, the supply chain for components is lengthy and often complex, but it is not significantly linked to the US, which helps mitigate the impact of direct tariffs.

For the furniture industry the telling figure is the volume of containers of furniture coming into Melbourne Port and what can our local manufacturers and our governments do to take back a slice of that pie. Be assured the Australian Furniture Association continue to work diligently on influencing government and our industry!

Opinion Written by Marcus Downie, AFA

* Source and Graphics Victorian Chamber of Commerce and Industry Webinar